.406 Ventures, a Boston-based venture firm investing in enterprise-focused startups in healthcare, data and AI, and cybersecurity, closed its fifth fund with $265 million in capital commitments.

The firm was founded by Liam Donohue, who was the founder of Boston venture firm Arcadia Partners, and two other partners, including Maria Cirino, co-founder of the managed-security services company Guardent, and former Razorfish CFO Larry Begley.

The new fund is backed by a group of new and existing limited partners, including university endowments, foundations, pension plans and strategic investors. Including the new fund, the 18-year-old firm has raised more than $1.4 billion across its five core funds and three opportunity funds.

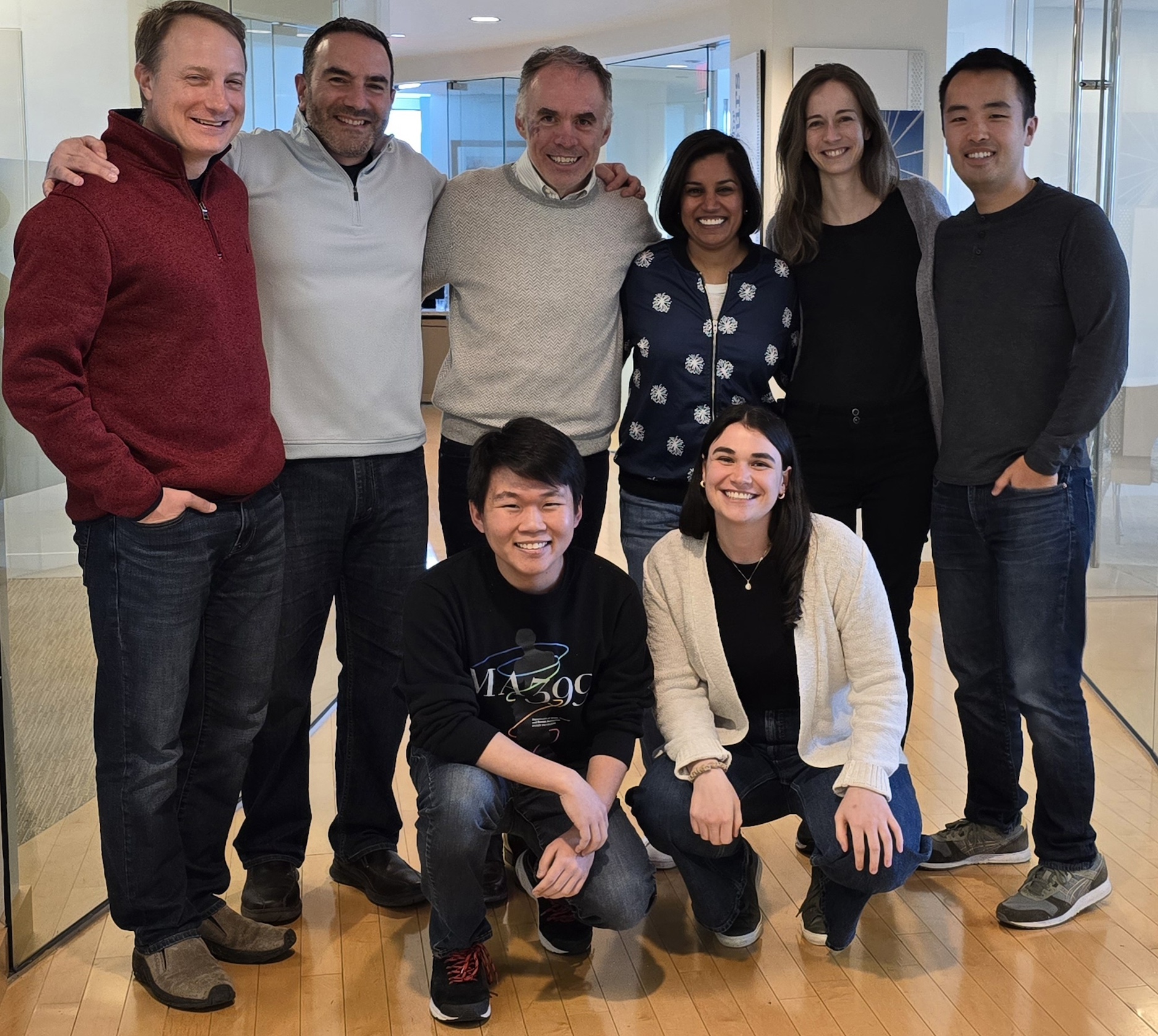

.406 Ventures investing team: Standing, from left, Graham Brooks, Greg Dracon, Liam Donohue, Payal Agrawal Divakaran, Kathryn Taylor Reddy and Kevin Wang. Kneeling, from left, Austin Kwoun and Rebecca Redfield. Image Credits: .406 Ventures

It’s been awhile since TechCrunch caught up with the firm. Speaking recently with Donohue, he said .406 Ventures’ focus hasn’t changed much during that time. The firm continues to invest in those same three industries and leverages the Boston tech ecosystem, though it does invest nationally.

However, unlike some of the firm’s previous funds, Donohue is seeing more repeat founders coming back for new investments.

“We wanted to be a partner so that a founder would come back to us for their next thing,” Donohue told TechCrunch. “In funds one and two, we had a couple of repeat founders. In the more recent funds, I’m excited to see so many great repeat partners coming back that a third of the fourth fund was repeat founders, and I’d expect about the same in fund five.”

Over the two decades, the firm has put together a portfolio of 87 companies, many of which have exited or gone public. Most recently those have included Iora Health, acquired by OneMedical in 2021 and now part of Amazon Health. Behavioral health company AbleTo is under Optum Health. Meanwhile, Carbon Black and CloudHealth Technologies are part of VMware while cybersecurity insurance company Corvus was acquired by Travelers in 2023.

.406 Ventures has already made investments in four companies from the new fund, including Portrait Analytics, the developer of a generative AI platform for investment research and thesis creation. It will invest in more than 20 companies with the new fund, Donohue said.

When looking at startups within the three verticals of healthcare, data and AI, and cybersecurity, the firm considers a number of factors, like the plan for infrastructure, especially now that AI is everywhere. It also taps into executive councils of over 100 C-suite operators from Fortune 500 companies.

“We ask ourselves, ‘What are the new technologies that are either going to need to be protected or will enhance and change the threat factors?’ Donohue said. “We’re always looking forward three to five years and anticipating where the vulnerabilities are going to be and then who is building the protections for this.”

Read the full article here