Let’s face it — the job market is tough. Between all of the layoffs in the tech industry and new job positions being created to leverage the artificial intelligence boom, company compensation teams need the best data to get out in front of industry changes, competition and costs.

TechCrunch profiled compensation market data provider Compa in 2021 when it raised $3.9 million in seed funding. The company’s technology included “deal desk” software for recruiters to more easily manage their compensation strategies to create and communicate offers that are easy to understand and are unbiased.

However, 2021 was a hot job market where pay was increasing rapidly, and companies were losing candidates at the compensation stage, Charlie Franklin, co-founder and CEO of Compa, told TechCrunch. In addition, inflation was coming, and the shift to remote work amid the global pandemic changed how companies thought about paying people.

Then came the layoffs, and as a result, “the compensation world has since been navigating extreme market volatility,” Franklin told TechCrunch.

“The market shifted in 2022,” he said. “There were lots of layoffs happening and lots of cost-cutting measures taking place. These compensation teams are flying blind, and so they’re turning to new solutions.”

Compa launched a product in May 2023 that aggregates compensation data across a network of participating companies. Typically, this is self-reported data often published in annual reports.

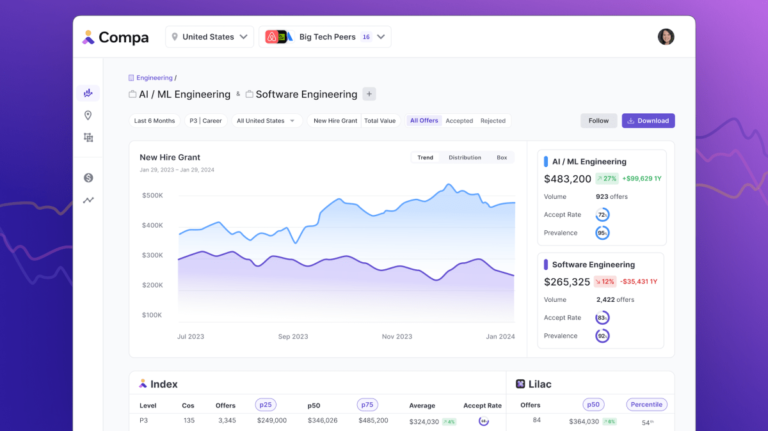

Through analysis of the offer data in real-time, compensation teams can then identify market changes faster and adapt their strategies to improve competitiveness and manage cost. Enterprise companies like Airbnb, NVIDIA, Stripe, Instacart, Block, DoorDash, Autodesk and Marvell Technology are among Compa’s customers.

Franklin gave an example of AI engineering jobs experiencing as much as a 240% premium over normal software engineering in the form of stock compensation, Franklin said.

“Our customers in these large companies will take that evidence and say, ‘It probably makes sense to track this separately in the market compared to traditional software engineering,’” he said. “That’s how they take data from our product and input that into a workforce planning decision.”

Meanwhile, Compa saw “explosive growth” in 2023 and grew its revenue 10x during that time, despite a down market, Franklin said. It also saw 793% data network growth across 17 countries.

All of that led the company to seek additional capital to grow faster. And investors were interested.

Compa today announced $10 million in Series A funding. Storm Ventures led the investment with participation from Penny Jar Capital, Indeed Ventures, NJP Ventures, Base10 Partners and Acadian Ventures.

The new capital will be deployed into expanding Compa’s network of participating companies in the data set, and then further enhancing compensation intelligence platform and technology. The company will have additional products out later this year around to address challenging compensation topics like stock-based compensation and skills, Franklin said.

The company is also hosting its first in-person event in February to bring together compensation teams around thought leadership.

“At the end of the day, our customers are trying to answer a single fundamental question, which is what’s happening in the market today, and we can answer with a product line as well as just connecting our community,” Franklin said.

Read the full article here