Bank and technology platform Kapital continues to rake in venture capital, grabbing another $40 million in Series B dollars and $125 million in debt financing. Tribe Capital led the Series B and was joined by backers, including Cervin Ventures, Tru Arrow, MS&AD Ventures and Alumni Ventures.

This marks the second investment for the Mexico City–based company this year. We previously covered Kapital’s $20 million Series A in May that included $45 million in debt.

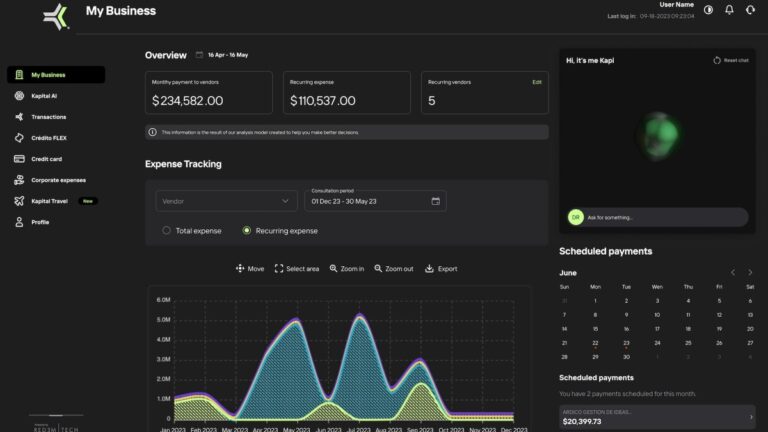

Rene Saul and Fernando Sandoval co-founded Kapital in 2020 to provide similar financial visibility to small businesses, using data and artificial intelligence, that large enterprises have. This enables customers to access and manage their business operations and cash flow in real time. The company also uses AI to underwrite small business loans.

“Small businesses represent 90% of the world’s businesses; however, in Mexico, only 10.5% of those small businesses have access to total bank credit,” Saul said. “That’s what we’re fixing — we give them visibility of their finances.”

In 2023, Kapital’s customer base grew to 80,000 small businesses in Mexico, Colombia and Peru. It also acquired Banco Autofin Mexico S.A. in September, which already had 65,000 customers, CEO Saul told TechCrunch. Kapital is profitable and grew revenue 6x in the past year.

Saul intends to deploy the new funding into R&D and technology development, particularly to bolster its cross-border offering and grow its product suite to provide insights for its customers. One of the areas Kapital would like to accelerate is predictive analytics technology so that business customers know how to improve margins by selecting different vendors.

“Now we have a bank and we can create embedded finance options,” Saul said. “We also control the payments and can connect to everything around customers seamlessly. Having operations in three different countries in Latin America also means our customers can move the money faster. Our goal is to build a global bank to eventually connect everybody in the world.”

Read the full article here